See

and related DOWPIVOTS.COM And SPYPIVOTS.COM And

Alerts and Posts. (OVER 17 THOUSAND VIEWS!)

________________________________________________________

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP: INCLUDING MOTION

DYNAMICS AND PRECISION PIVOTS MODEL ALERTS, OTAPS SIGNALS, CHART

ILLUSTRATIONS, ANALYSIS, AND COMMENTARY IN REAL-TIME.

ProtectVest and AdvanceVEST By EchoVectorVEST MDPP Precision Pivots

ProtectVest and AdvanceVEST By EchoVectorVEST MDPP Precision Pivots

Providing

Forecasting and Trade Management Technology, Analysis, and Education

Consistent With More Than Doubling the Portfolio Position Value of The

Major Market(Dow 30 Industrials, DIA ETF) From Mid-2007 to Early

2009!... More Than Doubling Again from Early 2009 through 2010!... Then

More Than Doubling Again in 2011!... And Then More Than Tripling Again

in 2012!... "Staying ahead of the curve, we're keeping watch for you!"

DOWPIVOTS.COM IS

A DIVISION OF PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP

PRECISION PIVOTS. FIND MOTION DYNAMICS AND PRECISION PIVOTS REAL-TIME

MODEL ALERTS, OTAPS SIGNALS, CHART ILLUSTRATIONS, ANALYSIS, AND

COMMENTARY FOR DOWPIVOTS.COM FOCUS ETFS AND FUTURES AT

ECHOVECTORVEST.BLOGSPOT.COM (LISTED 1ST IN LINKS ON RIGHT AT SITE).

See Also Related Websites and Blogsites

"For any base security I at price/time point A, A found having print

price p at print time t, then EchoVector XEV of I of time (cycle) length

X for starting time/price point A would be (I, Apt, XEV) where the

echovector's end point is (I, Apt) and the echovector's starting point

is I, Ap-N, t-X, where N is the found print price difference between A

and EchoBackTimePoint A (A, p-N, t-X at t-X) of Echo-Back-Time-Length,

or Echo-Cycle Length, X. A, p-n, t-X shall be called B, or B of I, being

the EBDTPP (Echo-Back-Date-Time-And-Price-Point)*, or Echo-Back-Date

(EBD)*, or Echo-Back-Time-Point (EBTP) of A of I.

N = difference of p at A and p at B (B is the 'echo-back price-point, and time-point, of A, found at A, p-N, t-X.

And I (I, Apt, XEV) shall have an echobacktimepoint (EBTP) of At-X, or

I-A-EBTP of At-X, (or echobackdate (EBD) I-A-EBD of At-X), t often

displayed on a chart measured and referenced in discrete d measurement

length units (often OHLC or candlestick widthed and lengthed

units[bars]), such as minute, 5-minute, 15-minute, 30-minute, hourly,

2-hour,4-hour, 6-hour, 8-hour, daily, weekly, etc."

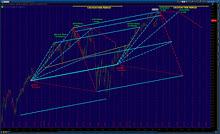

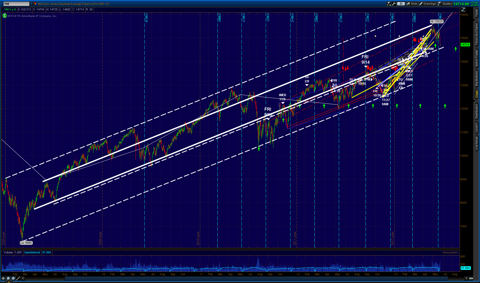

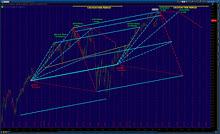

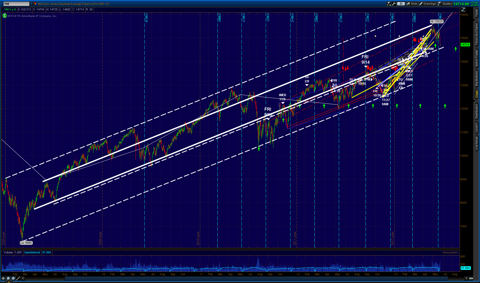

/YM DOW FUTURES CHART 4-YEAR DAILY OHLC

(click to zoom)

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS TRADER'S EDGE EASYGUIDECHART

PRECISION PIVOTS ECHOVECTORVEST MDPP MODEL OUTPUT CHART ILLUSTRATION AND HIGHLIGHTS COLOR CODE GUIDE

1. Regime Change Cycle EchoVector (8 Year, Week of month): Long Aqua-Blue

2. Regime Change Cycle EchoVector (8 Year, Week of month): Long Yellow

3. Regime Change Cycle EchoVector (8 Year, Week of month): Long Pink

4. Presidential Cycle EchoVector (4 Year, Day of week): Long White

5. Congressional Cycle EchoVector (2 Year, Day of week): Green

6. Congressional Cycle EchoVector (2 Year, Day of week): Blue Purple

7. Congressional Cycle EchoVector (2 Year, Day of week): Long Pink

8. Congressional Cycle EchoVector (2 Year, Day of week): Long Yellow

9. Annual Cycle EchoVector (1 Year, Day of week): Red

10. Annual Cycle EchoVector (1 Year, Day of week): Pink

11. Annual Cycle EchoVector (1 Year, Day of week): Aqua-Blue

12. Annual Cycle EchoVector (1 Year, Day of week): Long Blue Purple

13. 9-Month Cycle EchoVector (9 Months, Day of week): Grey

14. Bi-Quarterly Cycle EchoVector (6 Months, Day of week): Yellow

15. Bi-Quarterly Cycle EchoVector (6 Months, Day of week): Grey

16. Quarterly Cycle EchoVector (3 Months, Day of week): White

17. Quarterly Cycle EchoVector (3 Months, Day of week): Grey

18. Quarterly Cycle EchoVector (3 Months, Day of week): Red

19. Quarterly Cycle EchoVector (3 Months, Day of week): Green

20. Bi-Monthly Cycle EchoVector (2 Months, Day of week): Black

21. Monthly Cycle EchoVector (1 Month, Day of week): Peach

22. Bi-Weekly Cycle EchoVector (2 Weeks, Day of week): Grey

23. Weekly Cycle EchoVector (1 Week, Day of week): Aqua Blue

24. Daily Cycle EchoVector (1 Day, Day-over-Day): Short Pink

25. Select Support or Resistance Vectors and/or Relative Price Extension Vectors (Various Lengths): Navy Blue

Space-Color Vector Highlights are Graphical Illustrations of

Corresponding and Coordinate Color-Length-Slope MDPP Forecast Model Key

Active Focus EchoVectors.

ECHOVECTORVEST MDPP PRECISION PIVOTS MODEL LOGICS:

Trend period echovector echo-period price point level.

Trend period echovector echo-period price point level pivot extension: equal.

Trend period echovector echo-period price point level pivot extension: stronger: potential echovector slope pivoting effect.

Trend period echovector echo-period price point level pivot extension: weaker: potential echovector slope pivoting effect.

Trend period echovector echo-period price point level REVERSAL: Counter-Echo Pattern: Trend period echovector slope pivoting.

EP: EchoPivot: Trend Timing and Price Vector and Period Corresponding Pivot.

EPCP:

EchoPivot CounterPivotPivot: Trend Timing and Price Vector and Period

CounterTrend Corresponding CounterPivot (Induces greater force-slope up,

or weaker force-slope up, or greater force-slope down, or weaker

force-slope down).

CLICK ON CHARTS TO HYPER-ZOOM CHARTS

________________________________________________________

HYPER-ZOOM CHARTS

LINKS

OTAPS ALERTS

Introducing

the Active Advanced Management On/Off/Through Vector Target Application

Price Switch. Position Management and Value Optimization Technology.

POSITION DOUBLE LEVERAGE AND DOUBLE DOUBLE LEVERAGE ALERTS

Introducing

P&A Active Advanced Management Double and Double Double Positioning

Technology For Select Instruments and Key Focus Interest Opportunity

Periods

OPTIMIZING LEVERAGE WITH DERIVATIVES AND SYNTHETICS

Introducing

ProtectVEST and AdvanceVEST Active Advance Derivatives Management

Levels 1, 2, 3 , and 4 Technology For Position Value Hedging and Value

Optimizing Strategies

RELATED LINKS

Blog Archive

▼

2013 (418)

FORECAST MODEL & ALERT PARADIGM & ACTIVE ADVANCED MANAGEMENT & TRADE TECHNOLOGY

*Daytraders interested in shorter-term market mechanics and OTAPS ALERTS

also taking advantage of intra-day time-horizon price deltas and

advanced OTAPS position management technologies for the DIA, GLD, and

USO, also see:

http://www.echovectorvest.blogspot.com/

Also see Chronologies and Summaries and Results for the EchoVectorVEST

MDPP Major Price Delta and Price Pivot ALERTS for the Gold Metals Market

(GLD ETF /GC Futures) and the Crude Oil Market (USO ETF and /QM and /CL

Futures) in Q2, 2012, and in Q1.

EchoVectorVEST MDPP: Powerful Results From A Powerful, Active, and Advanced Forecast And Position Management Methodology.

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS

"Staying ahead of the curve, we're keeping watch for you."

________________________________________________________

FOR TODAY'S KEY CHARTS AND ANALYSIS, SEE:

EchoVectorVEST MDPP

AND,

http://seekingalpha.com/author/kevin-wilbur/instablog/full_index

________________________________________________________

Click on the links below for direct access to the following:

OUR RECORD:

www.echovectorvest.com/OUR RECORD

OUR RESEARCH:

www.echovectorvest.com/OUR RESEARCH

OUR CURRENT FOCI:

www.echovectorvest.com/OUR CURRENT FOCUS INSTRUMENTS

TRADEMARK MODEL ONTOLOGY AND TERMINOLOGY MATRIX:

www.echovectorvest.com/THE ECHOVECTORVEST MDPP TRADEMARK TERMINOLOGY MATRIX

ACTIVE ADVANCED POSITION MANAGEMENT TECHNOLOGY:

www.echovectorvest.blogspot.com/PROTECTVEST

AND ADVANCEVEST BY ECHOVECTORVEST MDPP ADVANCED ACTIVE POSITION

MANAGEMENT TECHNOLOGY:THE ON/OFF/THROUGH VECTOR TARGET APPLICATION PRICE

SWITCH

EXHIBIT WEEK RESULTS:

www.echovectorvest.blogspot.com/ADVANCED MANAGEMENT EXHIBIT WEEK RESULTS FOR THE GLD ETF AND THE DIA ETF

HIGH FREQUENCY TRADING DEMONSTRATION:

www.echovectorvest.blogspot.com/ECHOVECTORVEST MDPP HIGH FREQUENCY TRADING DEMONSTRATION AND POSITION TERMINOLOGY

DIAMOND OF SUCCESS:

www.echovectorvest.com/THE DIA ETF: THE DIAMOND OF SUCCESS

GOLD METALS:

www.echovectorvest.com/THE GLD ETF AND GOLD METALS

LIGHT SWEET CRUDE OIL:

www.echovectorvest.com/THE USO AND LIGHT SWEET CRUDE OIL

BIO, FOUNDER:

www.echovectorvest.com/BIO, PRESIDENT AND FOUNDER

Posted by

EchoVectorVEST

________________________________________________________

What is

ECHOVECTORVEST MDPP?

________________________________________________________

DISCLAIMER

This post is for information purposes only.

There

are risks involved with investing including loss of principal.

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP makes no explicit or

implicit guarantee with respect to performance or the outcome of any

investment or projections presented or discussed by PROTECTVEST AND

ADVANCEVEST BY ECHOVECTORVEST MDPP.

There

is no guarantee that the goals of the strategies discussed by

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP will be achieved.

NO

content published by us on the Site, our Blog, and any Social Media we

engage in constitutes a recommendation that any particular investment

strategy, security, portfolio of securities,

or transaction is suitable for any specific person. Further understand

that none of our bloggers, information providers, App providers, or

their affiliates are advising you personally concerning the nature,

potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter.

Again, this post is for information purposes only.

Before making any investment decisions we recommend you first consult with you personal financial advisor.

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP

"We're keeping watch for you."

TAGS: Stock Market Education, ETF Analysis, Major Market Composite

Index, Market Outlook, Market Analysis, Technical Analysis, Cyclical

Analysis, Price Analysis, Economy, Macro Outlook, Trading, Day Trading,

Swing Trading, Investing, Dow Futures, S&P Futures, Stock Market

Education, Market Forecast, Market Opinion and Analysis, EchovectorVEST,

Portfolio Insurance, Portfolio Management

Following

Send Message

View as an RSS Feed

__________________________________________________________

Themes:

Stock Market Education,

Financials,

Futures,

Federal Reserve,

Portfolio,

Market Currents,

ETFs,

Macro View,

Alerts,

Market Outlook,

Economy,

ETF Long and Short Ideas,

ETF Analysis,

Long Ideas,

Commodities,

EchoVectorVEST,

Technical Analysis

Themes:

Stock Market Education,

Futures,

Federal Reserve,

Market Currents,

ETFs,

Macro View,

Alerts,

Market Outlook,

Economy,

ETF Long and Short Ideas,

ETF Analysis,

Long Ideas,

Commodities,

EchoVectorVEST,

Technical Analysis,

MDPP Precision Pivots ForecastStocks:

QQQ,

PSQ,

QLD,

QID,

IWM,

RWM,

UWM,

UKK,

TWM,

DIA,

DOG,

DDM,

DXD,

TLT,

TLH,

IEF,

UUP,

UDN,

GLD,

GTU,

DGZ,

UGL,

DZZ,

GLL,

IAU,

SGOL,

SLV,

DBS,

AGQ,

ZSL,

CU,

PALL,

PPLT,

VXX,

UVXY,

XIV,

TVIX,

XLI,

TNA,

SPXU,

IVV,

TQQQ,

SQQQ,

SPLV,

SPY,

SSO,

SDS

Themes:

Stock Market Education,

Futures,

Federal Reserve,

Market Currents,

ETFs,

Macro View,

Alerts,

Market Outlook,

Economy,

ETF Long and Short Ideas,

ETF Analysis,

Long Ideas,

Commodities,

EchoVectorVEST,

Technical Analysis,

MDPP Precision Pivots ForecastStocks:

QQQ,

PSQ,

QLD,

QID,

IWM,

RWM,

UWM,

UKK,

TWM,

DIA,

DOG,

DDM,

DXD,

TLT,

TLH,

IEF,

UUP,

UDN,

GLD,

GTU,

DGZ,

UGL,

DZZ,

GLL,

IAU,

SGOL,

SLV,

DBS,

AGQ,

ZSL,

CU,

PALL,

PPLT,

VXX,

UVXY,

XIV,

TVIX,

XLI,

TNA,

SPXU,

IVV,

TQQQ,

SQQQ,

SPLV,

SPY,

SSO,

SDS

No comments:

Post a Comment